Tilley Business Accountants are pleased to announce that it has been acquired by Aero Accounting Group. For more information about this exciting change and what it means for you, please click here for more information

Aero Accounting X Tilley Business Accountants is a

CPA Practice

Certified Partner of Xero and Quickbooks

Proudly serving local businesses and communities across Brisbane’s Inner South and Eastern suburbs for over 25 years, Tilley Accountants is your trusted partner for success. We are dedicated to delivering exceptional value through expert advice and professional services. By working hand-in-hand with our clients, we craft tailored solutions that empower businesses to thrive and achieve sustainable growth in today’s ever-evolving landscape. At Aero Accounting X Tilley Accountants, your success is our mission.

Our Business

BOOKKEEPING service

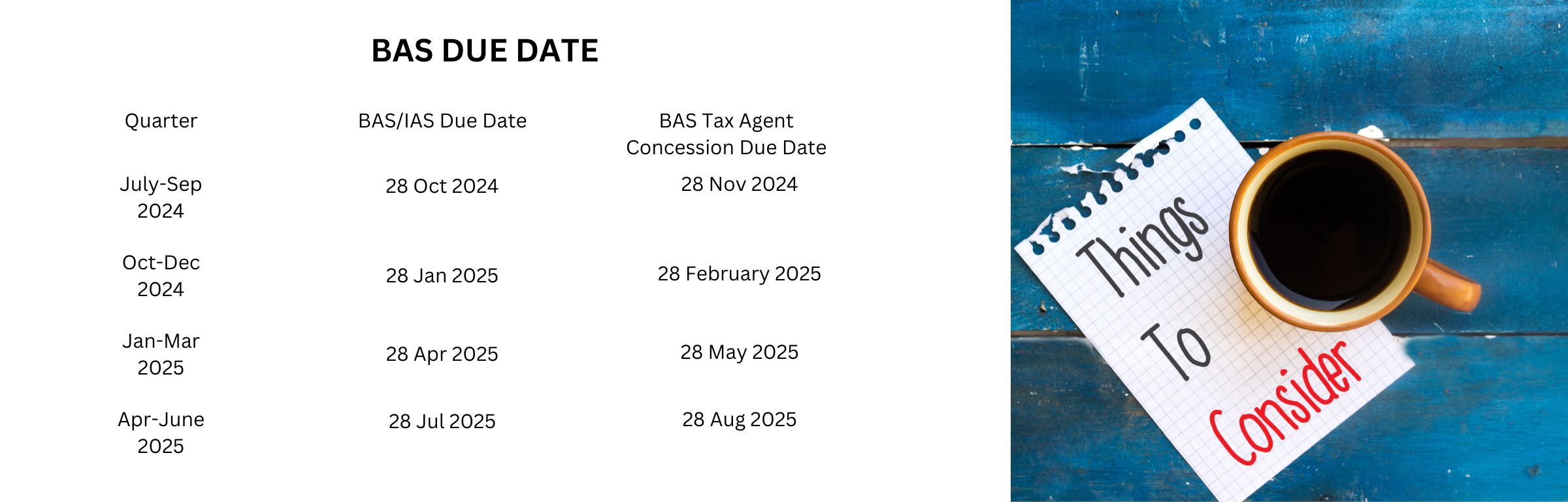

Tired of mounting paperwork and finding it stressful to balance your books? We tailor our bookkeeping service to meet your needs. By allowing us to handle your dealings with the ATO, you can rest assured that everything will be accounted for.

Choose one of our Bookkeeping & Accounting Packages or contact us for a tailor-made package for your business!